Measures to lower all state income taxes, require voters to approve fees could make November ballot

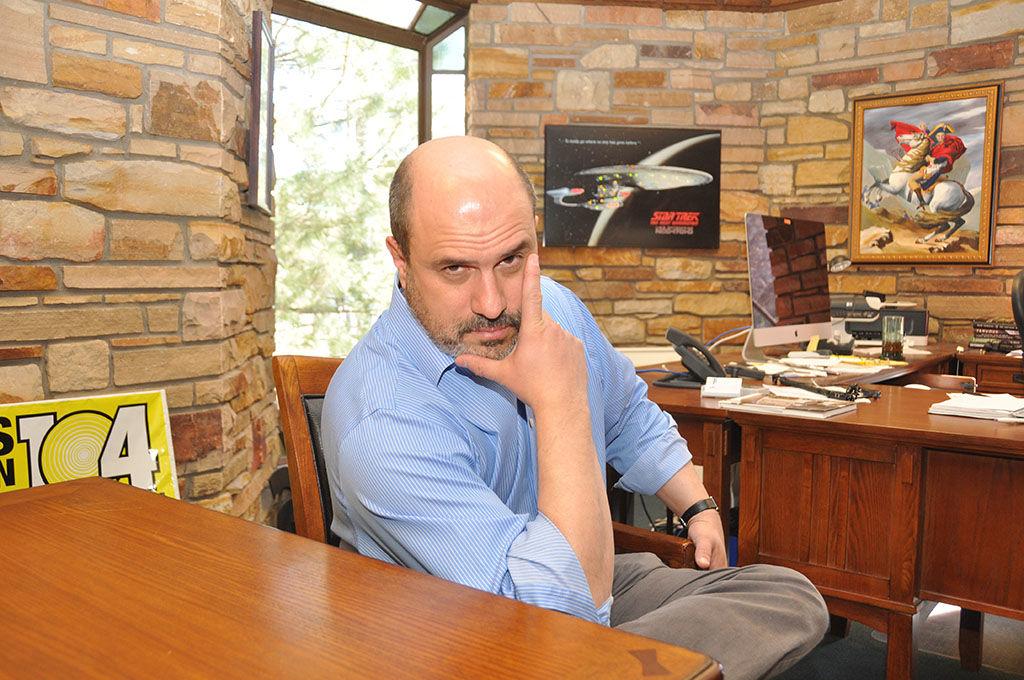

After Gov. Jared Polis announced Saturday that he would allow petition-gathering by mail and email, the conservative Independence Institute think tank in Denver announced a petition drive Monday to ask voters in November to reduce the state income tax rate from 4.63% to 4.55%. Initiative 306 is backed by a group called Energize our Economy, and […]

Colorado Rising State Action tees up ballot initiatives to inoculate TABOR

If there are still officials trying to get around Colorado’s Taxpayers Bill of Rights by turning to government fees instead of new taxes, a proposed ballot initiative could complicate things. Next week the Secretary of State’s Office title-setting board is expected hear a pitch for three November ballot measures on three questions, initiatives 273 to 275. […]

Kafer: I’m beginning to believe Democrats want Colorado’s drivers to be miserable

Deep within the bowels of Denver International Airport the Illuminati gather for their secret meetings. A bloodthirsty Chupacabra stalks sleeping cattle in the San Luis Valley to gorge upon their entrails. Aliens or government spy drones or both wander the night sky in northeastern Colorado. Centennial State conspiracy theories abound, but I’ve never given them […]

Hickenlooper faces renewed pressure and questions about his administration’s spending in final months

A little-noticed government account that is paying ongoing legal bills related to an ethics complaint against U.S. Senate candidate John Hickenlooper is facing renewed scrutiny even as the Democrat’s allies continue to block requests for an audit of the spending. In its final months, the former governor’s administration used federal funds from a 2003 account […]

Editorial: Hickenlooper’s budget trick with federal dollars is disappointing

Colorado state agencies, with a few exceptions, are not allowed to have their own rainy day funds to help them weather financial downturns. It’s the job of state lawmakers to make the tough decisions about where cuts will be made and how state savings funds will be used to spare some departments from those trims. […]

Colorado lawmakers vote down request to investigate if Hickenlooper misused federal fund

A state committee declined, on a party-line vote Monday, to investigate whether former Gov. John Hickenlooper misused a federal fund to pay for his defense of possible ethics violations. Republicans Sen. Paul Lundeen of Monument and Rep. Rod Bockenfeld of Watkins brought forward a request for the Legislative Audit Committee to conduct the review. In a letter […]

Hickenlooper’s attorney in ethics investigation is paid for by post-9/11 economic recovery fund

DENVER — A taxpayer-funded attorney is defending former Colorado Governor John Hickenlooper during an ethics investigation into trips he made in 2018. The state attorney general’s office hired Mark Grueskin, a well-known Democratic elections attorney, to defend Hickenlooper. According to current Governor Jared Polis’ office, Grueskin has billed the state for $43,390 so far, charging […]

Money for Hickenlooper’s attorney is from federal fund meant to help Colorado economy post-9/11

John Hickenlooper’s attorney has been paid $43,390 — at a rate of $525 per hour — in taxpayer money to defend him before the Colorado Independent Ethics Commission as part of an arrangement that dates back to the former governor’s time in office. It’s common for Colorado elected officials to be represented by government lawyers, or by […]